Corporate income tax or corporate tax is a direct tax that is paid to the government via IRBMLHDN it is governed under the Income Tax Act 1967. Devis tax computation from rental source for the year of assessment 2010 is as follows.

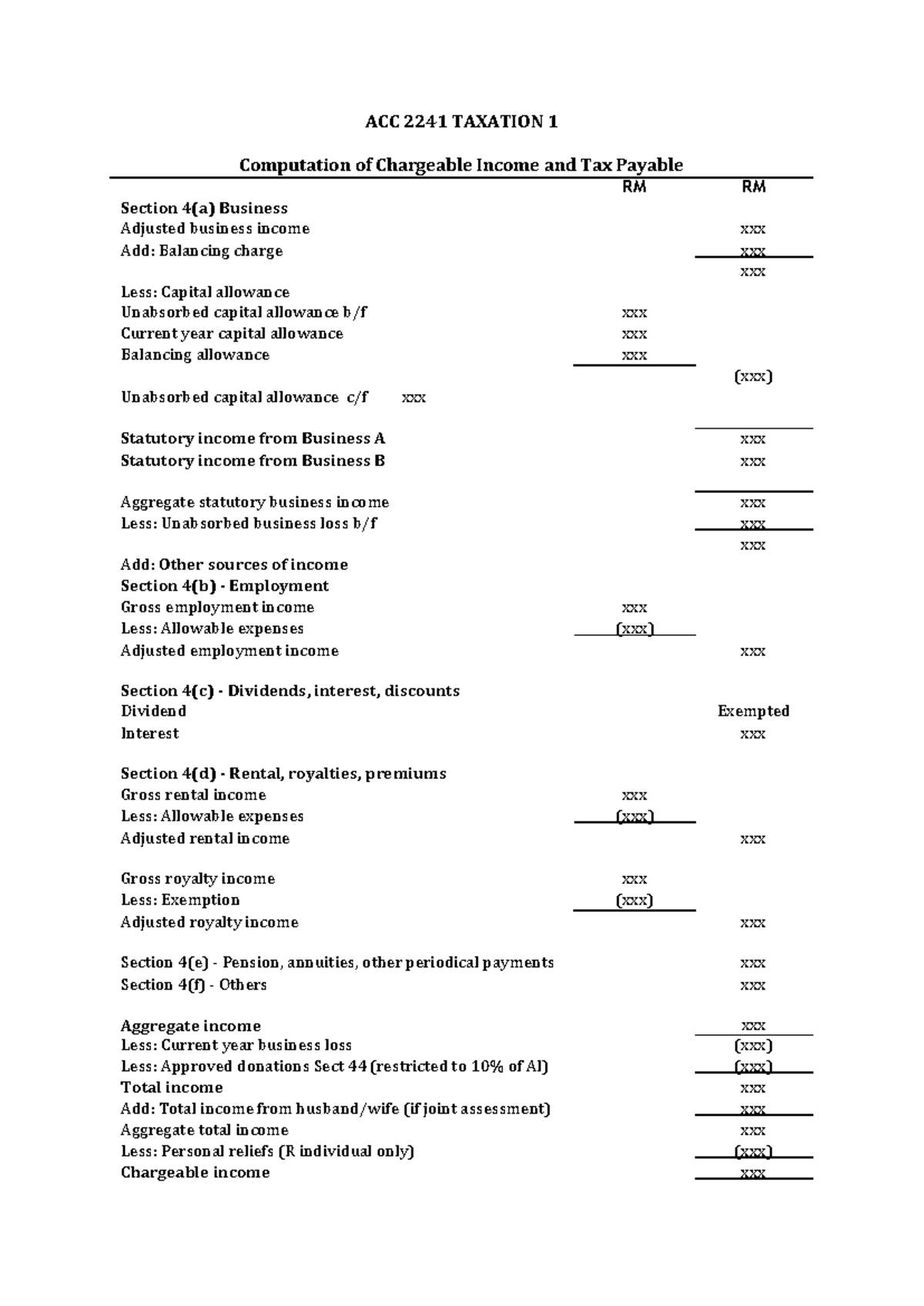

Acc 2241 Format For Chargeable Income Acc 2241 Taxation 1 Computation Of Chargeable Income And Tax Studocu

The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia.

. ASSESSMENT 400 ZAKAT AND OTHER ISLAMIC RELIGIOUS OBLIGATORY PAYMENT XXX DEPARTURE LEVY - Resident Individual leaving. This rate is relatively lower than what we have seen in the previous year. D He is not resident because he was not in Malaysia for the three preceding years of assessment and the following year of assessment.

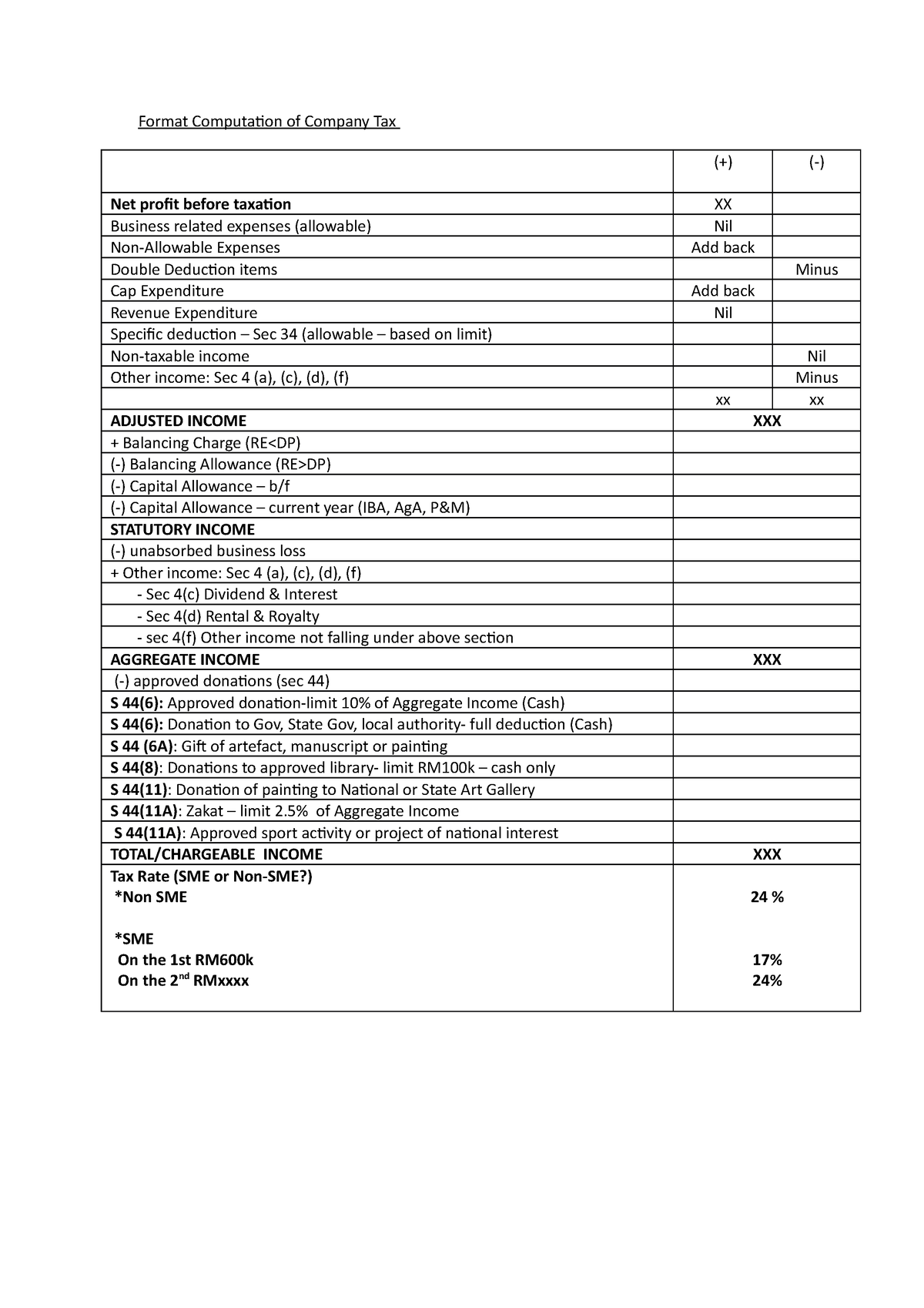

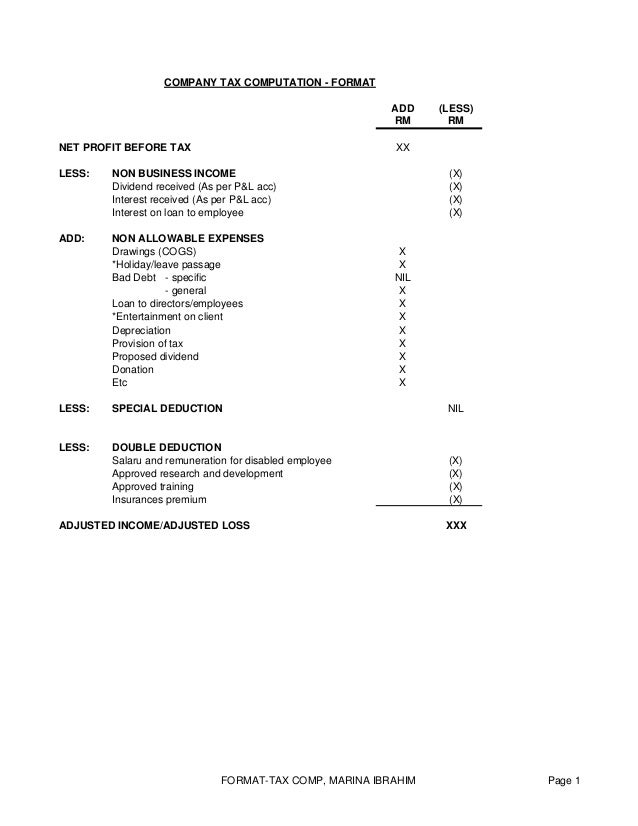

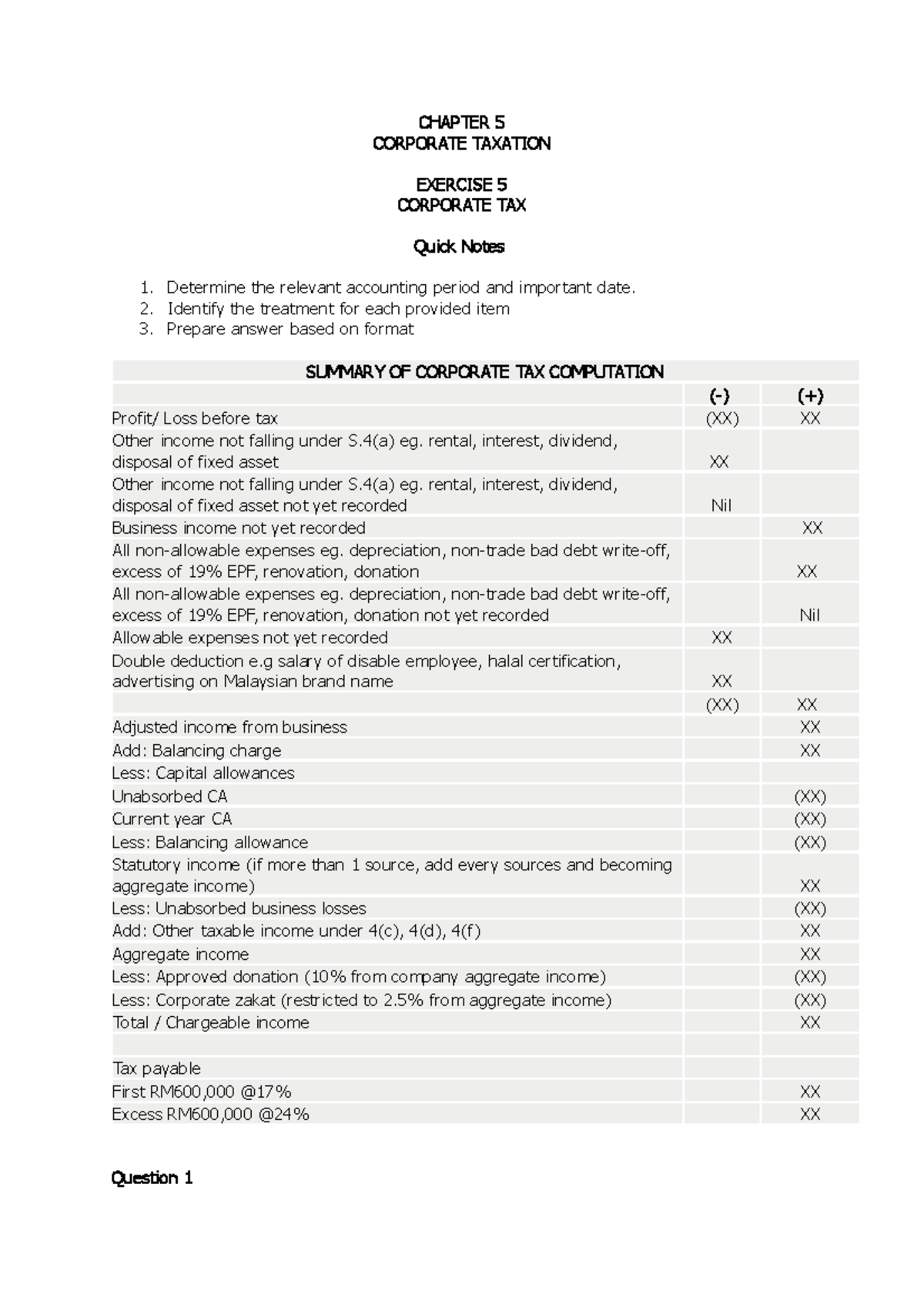

Companies are taxed at the 24 with effect from Year of Assessment 2016 while small-scale companies with paid-up capital not exceeding RM25 million are taxed as follows. 33 taxable income and rates. Wholly exclusively expenses.

Individual Business Income. 13 September 2018 Page 1 of 14 1. PART III COMPUTATION OF INCOME TAX AND TAX PAYABLE Public Ruling No.

A business owner and individual who running a business registering business with SSM Enterprise Sole Proprietor and have tax number OG with LHDN. Interest expense xx Adjusted Income xx Less. Leased Asset xx Statutory Income xx A Non Leasing Business.

The basis period for a company co- operative or trust body is normally the financial year FY ending in. Plant Machinery xx. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of.

Return Form RF Filing Programme. 62018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. 7 Devi has one condominium in Bukit Kenny.

Type of company. Chargeable income MYR CIT rate for year of assessment 20212022. Return Form RF Filing Programme For The Year 2021 Amendment 42021.

Lessor Company Name Computation of chargeable incom for YA XXXX RM Leasing business. The year of assessment YA is the year coinciding with the calendar year for example the YA 2018 is the year ending 31 December 2018. Tax Rate of Company.

Rate The first RM600000. A corporate tax rate of 17 to 24 is imposed upon resident and non-resident companies on taxable income that is sourced from or obtained in Malaysia. December are calculated based on the corporate income tax of.

Individual Business Income. Hereby declare that this return form contains information that is true correct and complete pertaining to the income tax of this company as required under the Income Tax Act 1967. Tax Deduction Exemption.

Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the business. Income is assessed on a current year basis. Corporate income tax in Malaysia is applicable to both resident and non-resident companies.

These companies are taxed at a rate of 24 Annually. The Malaysia Tax Calculator can help you calculate Profit Loss accounts deduct all allowable expenses deduct tax relief given by the government prevent you from claim unallowable expenses that can be penalised. Company with paid up capital more than RM25 million.

RM Gross rental income 100000 Less. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. She has no other properties.

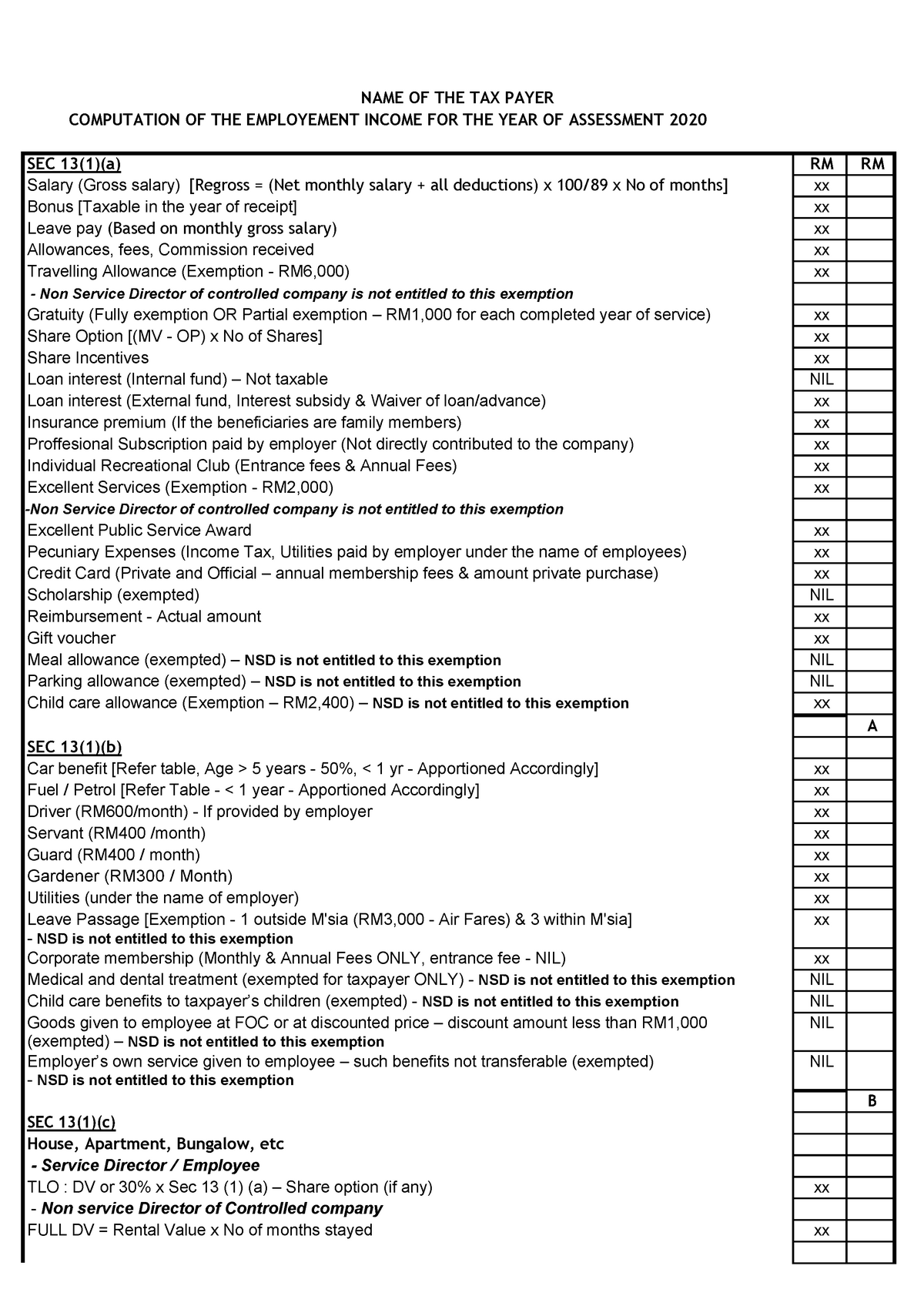

Rental income is filed under section 4d of the income tax act 1967. View PERSONAL TAX COMPUTATION- FORMATpdf from TAXATION BKAT2013 at University of Malaya. Gross Income xxx Less.

Contoh Format Baucar Dividen. Resident company Paid-up ordinary share capital First Excess over RM500000 RM500000 RM2500000 or less 20 25 More than RM2500000 25 25 Non-residents Company 25 Individual 26 Personal reliefs and allowances RM Self 9000 Disabled self additional 6000 Medical expenses expended for parents maximum 5000. Objective The objective of this Public Ruling PR is to explain the computation of income tax and the tax payable by an individual who is resident in Malaysia.

Annual allowance at the prescribed rates calculated on cost. With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million. Within 7 months after financial year end.

Company with paid up capital not more than RM25 million On first RM500000. Gross Income xxx Less. Small and medium enterprises SMEs pay slightly different company tax as compared to other resident companies.

1 This return form is prepared based on audited accounts. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses. Individual Tax Relief and Business Expenses.

Resident company other than company described below 24. 2 This return form is prepared based on unaudited accounts. INDIVIDUAL TAX COMPUTATION PERSONAL TAX COMPUTATION sec 4a sec 4b Statutory Business Income Convinient.

Individual Tax Relief and Business Expenses.

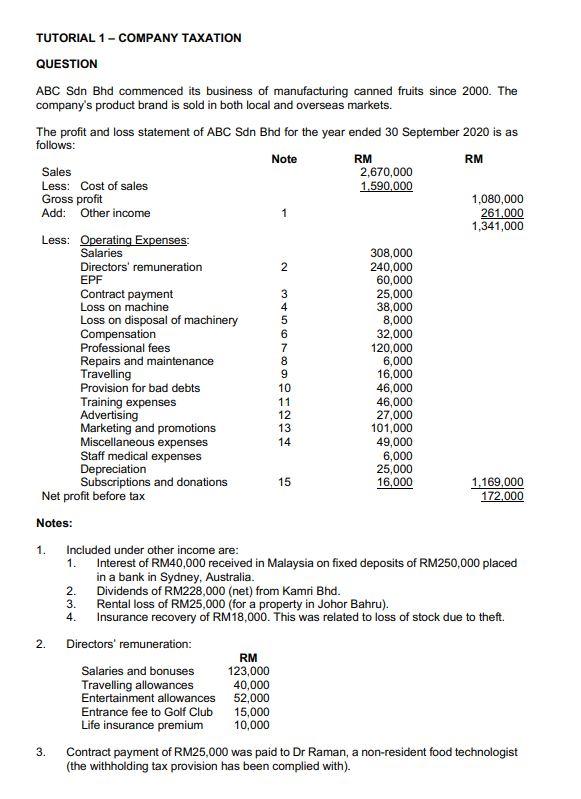

Tutorial 1 Company Taxation Question Abc Sdn Bhd Chegg Com

Malaysia Taxation Junior Diary Non Income Producing Dormant Inactive

Computation Format For Individual Tax Liability For The Year Of Assessment 20xx Docx Computation Format For Individual Tax Liability For The Year Of Course Hero

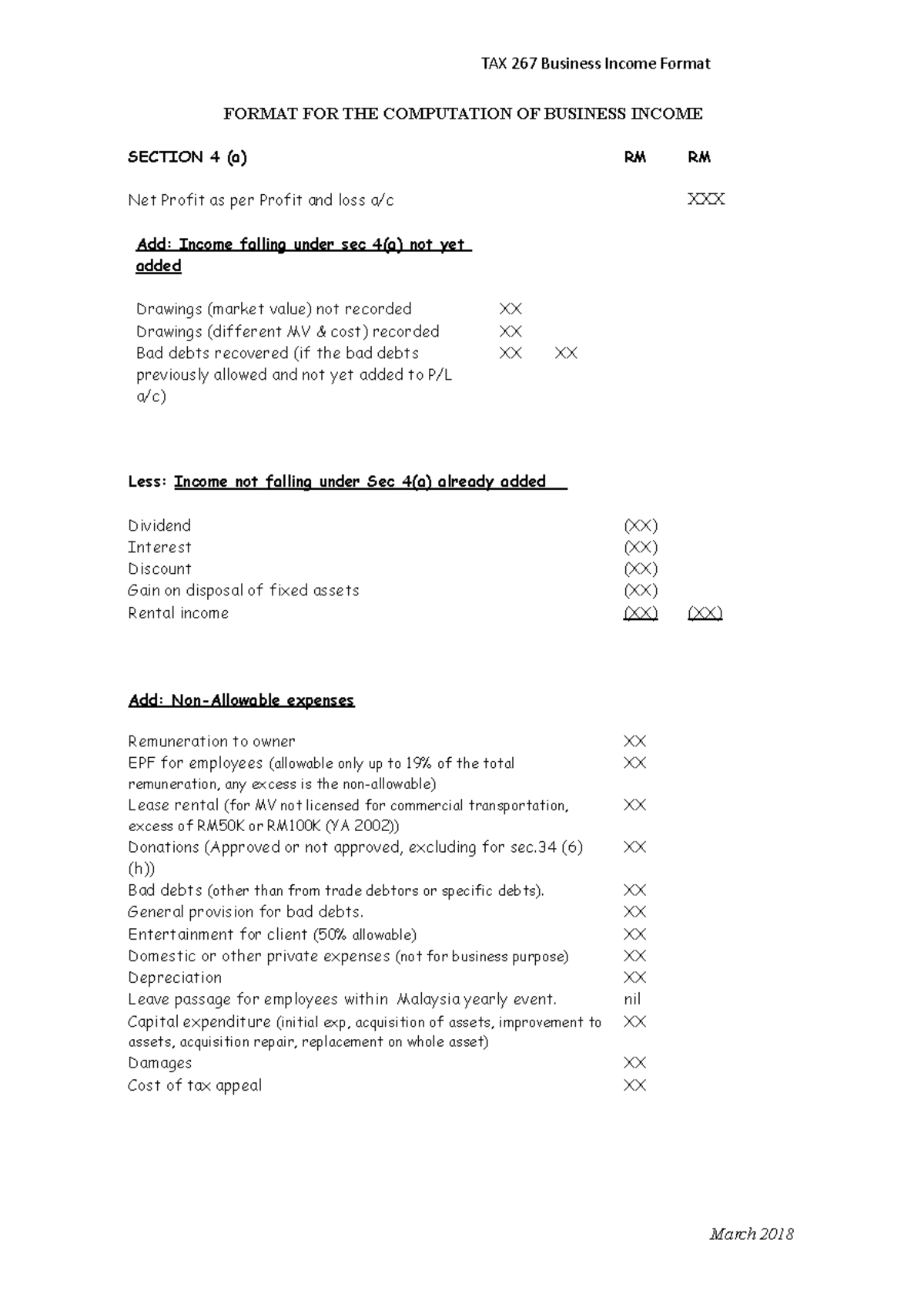

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

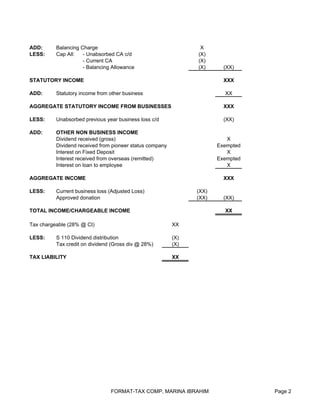

Company Tax Computation Format 1

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Joint And Separate Assessment Acca Global

Computation Format For Individual Tax Liability For The Year Of Assessment 20xx Pdf Expense Tax Deduction

Company Tax Computation Format

Format Computation Of Company Tax Format Computation Of Company Tax Format Computation Of Company Studocu

Chapter 8 Business Expenses And Tax Computation For Companies Chapter 8 1 Business Expenses And Tax Computation For Companies Companys Course Hero

Format Employment Income Ya 2020 Name Of The Tax Payer Computation Of The Employement Income For Studocu

Company Tax Computation Format

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

Chapter 5 Tutorial Taxation Chapter 5 Corporate Taxation Exercise 5 Corporate Tax Quick Notes Studocu

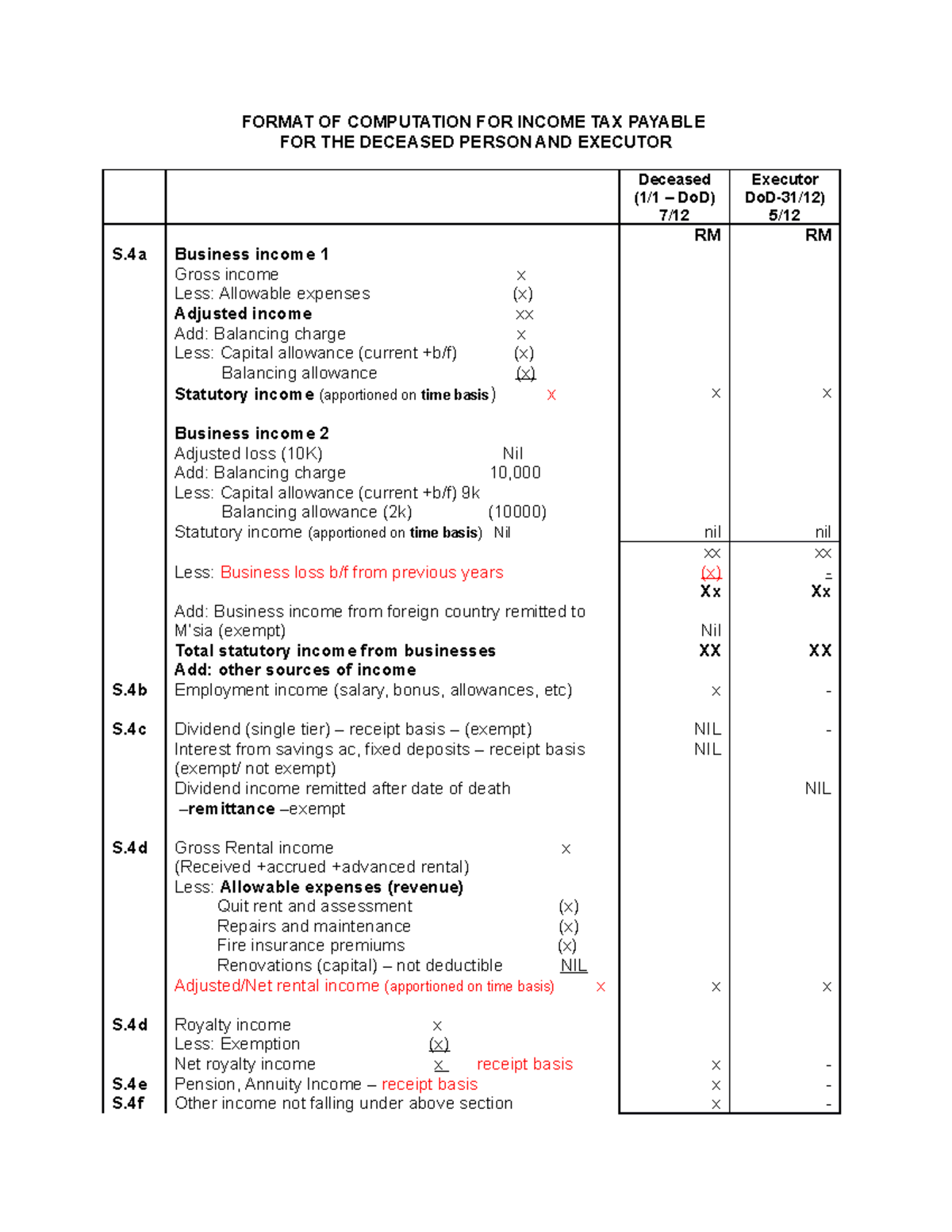

Computation For Individual Tax Liability For The Year Of Assessment 2019 Format Of Computation For Studocu

Malaysia Tax Computation Format Fill Online Printable Fillable Blank Pdffiller